Machine Learning Algorithms for Customer Churn Prediction in the Banking Sector: A Comparative Study

Main Article Content

Abstract

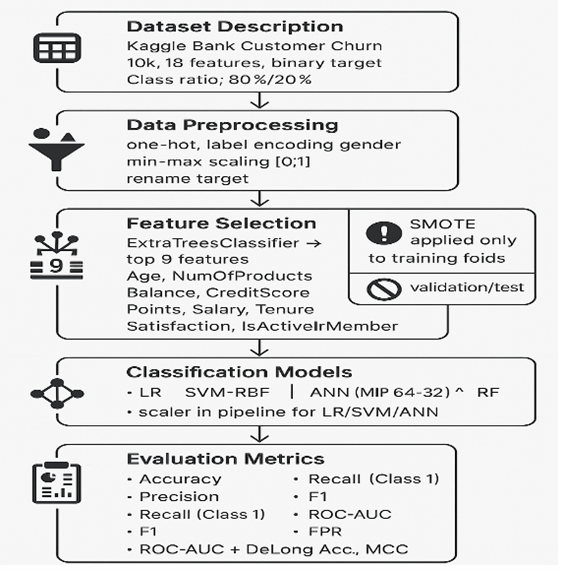

Predicting customer churn in retail banking is essential for sustaining profitability. This study compares four supervised machine-learning models—Logistic Regression (LR), Support Vector Machine (SVM), Random Forest (RF), and Artificial Neural Network (ANN)—using the publicly available bank customer churn dataset from Kaggle (10,000 records, 18 attributes; publicly available at Kaggle repository. Data preprocessing included one-hot encoding for categorical variables, label encoding for gender, and feature selection via an ExtraTreesClassifier retaining nine informative predictors (e.g., age, credit score, balance). To address class imbalance (≈80% nonchurners vs. 20% churners), models were trained and evaluated with and without the Synthetic Minority Oversampling Technique (SMOTE), which was applied only to the training folds under stratified 5-fold cross-validation. Evaluation metrics comprised accuracy, precision, recall (for churn class), F1-score, ROC–AUC, and PR–AUC. RF achieved the best balance between recall (0.484 imbalanced; 0.619 balanced) and accuracy (0.867 imbalanced), while LR with SMOTE attained the highest recall (0.715) at the cost of reduced accuracy (0.718). Overall, the results highlight RF as the most robust model across both distributions and emphasize the importance of imbalance-aware evaluation in bank churn prediction.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

M. A. Daqar, "The Readiness of the Palestinian Banking Industry to Fintech Era: Measuring the Fintech Ecosystem in Palestine," Magyar Agrár-és Élettudományi Egyetem, 2021.

A. Keramati, H. Ghaneei, and S. M. Mirmohammadi, "Investigating factors affecting customer churn in electronic banking and developing solutions for retention," International Journal of Electronic Banking, vol. 2, no. 3, pp. 185-204, 2020.

A. Keramati, H. Ghaneei, and S. M. Mirmohammadi, "Developing a prediction model for customer churn from electronic banking services using data mining," Financial Innovation, vol. 2, pp. 1-13, 2016.

Y. Suh, "Machine learning based customer churn prediction in home appliance rental business," Journal of big Data, vol. 10, no. 1, p. 41, 2023.

F. Ehsani, "Customer churn prediction from Internet banking transactions data using an ensemble meta-classifier algorithm," 2022.

D. Wadikar, "Customer Churn Prediction," 2020.

İ. O. Yiğit and H. Shourabizadeh, "An approach for predicting employee churn by using data mining," in 2017 international artificial intelligence and data processing symposium (IDAP), 2017: IEEE, pp. 1-4.

R. Thomas, "A Study of Mobile Banking in the State of Kerala," 2019.

T. Vafeiadis, K. I. Diamantaras, G. Sarigiannidis, and K. C. Chatzisavvas, "A comparison of machine learning techniques for customer churn prediction," Simulation Modelling Practice and Theory, vol. 55, pp. 1-9, 2015.

V. Avon, "Machine learning techniques for customer churn prediction in banking environments," 2016.

A. Amin et al., "Customer churn prediction in the telecommunication sector using a rough set approach," Neurocomputing, vol. 237, pp. 242-254, 2017.

O. Çelik and U. O. Osmanoglu, "Comparing to techniques used in customer churn analysis," Journal of Multidisciplinary Developments, vol. 4, no. 1, pp. 30-38, 2019.

R. A. de Lima Lemos, T. C. Silva, and B. M. Tabak, "Propension to customer churn in a financial institution: A machine learning approach," Neural Computing and Applications, vol. 34, no. 14, pp. 11751-11768, 2022.

S. W. Fujo, S. Subramanian, and M. A. Khder, "Customer churn prediction in telecommunication industry using deep learning," Information Sciences Letters, vol. 11, no. 1, p. 24, 2022.

M. H. Seid and M. M. Woldeyohannis, "Customer Churn Prediction Using Machine Learning: Commercial Bank of Ethiopia," in 2022 International Conference on Information and Communication Technology for Development for Africa (ICT4DA), 2022: IEEE, pp. 1-6.

A. M. Almana, M. S. Aksoy, and R. Alzahrani, "A survey on data mining techniques in customer churn analysis for telecom industry," International Journal of Engineering Research and Applications, vol. 4, no. 5, pp. 165-171, 2014.

W. Li and C. Zhou, "Customer churn prediction in telecom using big data analytics," in IOP Conference Series: Materials Science and Engineering, 2020, vol. 768, no. 5: IOP Publishing, p. 052070.

A. Bilal Zorić, "Predicting customer churn in banking industry using neural networks," Interdisciplinary Description of Complex Systems: INDECS, vol. 14, no. 2, pp. 116-124, 2016.

R. Duchemin and R. Matheus, "Forecasting customer churn: Comparing the performance of statistical methods on more than just accuracy," Journal of Supply Chain Management Science, vol. 2, no. 3-4, pp. 115-137, 2021.

C. C. Valluri, "The Many Types of Churn and Their Predictive Models," Creighton University, 2019.

E. Stripling, S. vanden Broucke, K. Antonio, B. Baesens, and M. Snoeck, "Profit maximizing logistic model for customer churn prediction using genetic algorithms," Swarm and Evolutionary Computation, vol. 40, pp. 116-130, 2018.

R. Yahaya, O. A. Abisoye, and S. A. Bashir, "An enhanced bank customers churn prediction model using a hybrid genetic algorithm and k-means filter and artificial neural network," in 2020 IEEE 2nd International Conference on Cyberspac (CYBER NIGERIA), 2021: IEEE, pp. 52-58.

P. Verma, "Churn prediction for savings bank customers: A machine learning approach," Journal of Statistics Applications & Probability, vol. 9, no. 3, pp. 535-547, 2020.

M. Abiad, "customer churn analysis using binary logistic regression model," PhD Student, Faculty of Entrepreneurship, Business Engineering and Management, University Politehnica of Bucharest, Bucharest, Romania; College of Business Administration, American University of the Middle East, Kuwait, Mohammad.abiad@aum.edu.kw, 2020, doi: https://doi.org/10.54729/2959-331X.1021

E. Domingos, B. Ojeme, and O. Daramola, "Experimental analysis of hyperparameters for deep learning-based churn prediction in the banking sector," Computation, vol. 9, no. 3, p. 34, 2021.

M. Braun and D. A. Schweidel, "Modeling customer lifetimes with multiple causes of churn," Marketing Science, vol. 30, no. 5, pp. 881-902, 2011.

A. A. Umar, I. Saaid, and A. A. Sulaimon, "Rheological and stability study of water-in-crude oil emulsions," in AIP Conference Proceedings, 2016, vol. 1774, no. 1: AIP Publishing.

K. Coussement and K. W. De Bock, "Customer churn prediction in the online gambling industry: The beneficial effect of ensemble learning," Journal of Business Research, vol. 66, no. 9, pp. 1629-1636, 2013.

Y. Richter, E. Yom-Tov, and N. Slonim, "Predicting customer churn in mobile networks through analysis of social groups," in Proceedings of the 2010 SIAM international conference on data mining, 2010: SIAM, pp. 732-741.

V. Mahajan, R. Misra, and R. Mahajan, "Review of data mining techniques for churn prediction in telecom," Journal of Information and Organizational Sciences, vol. 39, no. 2, pp. 183-197, 2015.

V. Mahajan, R. Misra, and R. Mahajan, "Review on factors affecting customer churn in telecom sector," International Journal of Data Analysis Techniques and Strategies, vol. 9, no. 2, pp. 122-144, 2017.

A. De Caigny, K. Coussement, and K. W. De Bock, "A new hybrid classification algorithm for customer churn prediction based on logistic regression and decision trees," European Journal of Operational Research, vol. 269, no. 2, pp. 760-772, 2018.

V. Kirmaci and H. Kaya, "Effects of working fluid, nozzle number, nozzle material and connection type on thermal performance of a Ranque–Hilsch vortex tube: A review," International Journal of Refrigeration, vol. 91, pp. 254-266, 2018.

J. Kacprzyk, "Lecture notes in networks and systems," (No Title), 2019.

M. A. Nikolaevic, "Creation of a Churn Model for the Company and Processes for Churn Reduction," 2020.

P. Lalwani, M. K. Mishra, J. S. Chadha, and P. Sethi, "Customer churn prediction system: a machine learning approach," Computing, pp. 1-24, 2022.

W. Park and H. Ahn, "Not All Churn Customers Are the Same: Investigating the Effect of Customer Churn Heterogeneity on Customer Value in the Financial Sector," Sustainability, vol. 14, no. 19, p. 12328, 2022.

S. T. Khine and W. W. Myo, "Customer Churn Analysis in Banking Sector," MERAL Portal, 2016.

T. Davenport, A. Guha, D. Grewal, and T. Bressgott, "How artificial intelligence will change the future of marketing," Journal of the Academy of Marketing Science, vol. 48, pp. 1-19, 10/01 2019, doi: 10.1007/s11747-019-00696-0.

W. Ertel, Introduction to artificial intelligence. Springer, 2018.

D. Vrontis, M. Christofi, V. Pereira, S. Tarba, A. Makrides, and E. Trichina, "Artificial intelligence, robotics, advanced technologies and human resource management: a systematic review," The international journal of human resource management, vol. 33, no. 6, pp. 1237-1266, 2022.

G. Vilone and L. Longo, "Notions of explainability and evaluation approaches for explainable artificial intelligence," Information Fusion, vol. 76, pp. 89-106, 2021.

D. Acemoglu and P. Restrepo, "Artificial intelligence, automation, and work," in The economics of artificial intelligence: An agenda: University of Chicago Press, 2018, pp. 197-236.

G. Chassagnon, M. Vakalopoulou, N. Paragios, and M.-P. Revel, "Artificial intelligence applications for thoracic imaging," European journal of radiology, vol. 123, p. 108774, 2020.

A. Pannu, "Artificial intelligence and its application in different areas," Artificial Intelligence, vol. 4, no. 10, pp. 79-84, 2015.

N. J. Nilsson, Principles of artificial intelligence. Springer Science & Business Media, 1982.

S. Zhao, F. Blaabjerg, and H. Wang, "An overview of artificial intelligence applications for power electronics," IEEE Transactions on Power Electronics, vol. 36, no. 4, pp. 4633-4658, 2020.

A. Kaplan and M. Haenlein, "Rulers of the world, unite! The challenges and opportunities of artificial intelligence," Business Horizons, vol. 63, no. 1, pp. 37-50, 2020.

B. W. Wirtz, J. C. Weyerer, and C. Geyer, "Artificial intelligence and the public sector—applications and challenges," International Journal of Public Administration, vol. 42, no. 7, pp. 596-615, 2019.

A. Bécue, I. Praça, and J. Gama, "Artificial intelligence, cyber-threats and Industry 4.0: Challenges and opportunities," Artificial Intelligence Review, vol. 54, no. 5, pp. 3849-3886, 2021.

D. L. García, À. Nebot, and A. Vellido, "Intelligent data analysis approaches to churn as a business problem: a survey," Knowledge and Information Systems, vol. 51, no. 3, pp. 719-774, 2017.

S. D. Meli, Y. F. Djoumessi, and C. F. Djiogap, "Analysis of the socio-economic determinants of mobile money adoption and use in Cameroon," Telecommunications Policy, vol. 46, no. 9, p. 102412, 2022.

N. Rane, "Enhancing customer loyalty through Artificial Intelligence (AI), Internet of Things (IoT), and Big Data technologies: improving customer satisfaction, engagement, relationship, and experience," Internet of Things (IoT), and Big Data Technologies: Improving Customer Satisfaction, Engagement, Relationship, and Experience (October 13, 2023), 2023.