Factors Influencing the Adoption of Mobile Banking Applications in Yemen Using an Extended Technology Acceptance Model

Main Article Content

Abstract

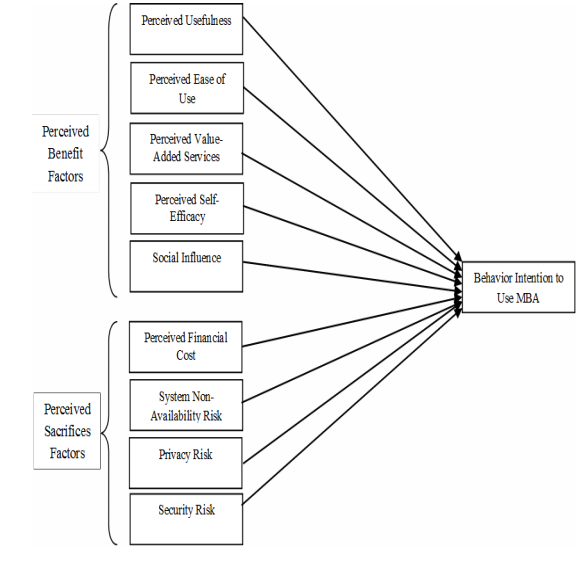

In the Yemeni environment, the adoption rate of Mobile Banking Applications (MBA) is lower than expected by banks, and there is a lack of studies that have examined MBA adoption in Yemen. The rapid development in wireless technology and the widespread use of cell phones have motivated banks to invest their budget in building Mobile Banking Applications (MBA). However, the adoption rate of MBA in Yemen falls short of banks’ expectations, and there is a scarcity of studies investigating the factors related to MBA adoption. Therefore, this study aims to extend the current understanding of MBA adoption by proposing a theoretical model to investigate the factors influencing Yemeni customers’ adoption of MBA. The proposed model extends the Technology Acceptance Model (TAM). Data were collected through a survey questionnaire completed by 473 participants. This study empirically concludes that individuals’ intention to adopt MBA is significantly and positively influencedby perceived usefulness, perceived ease of use, perceived value-added services, perceived self-efficacy, social influence, financial cost, perceived system non-availability risk, perceived privacy risk, and perceived security risk.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.